It was like reading the obituary of a young person you never knew personally, but who had a life full of promise ahead of them, cut brutally short…

GE Appliances announced last Tuesday that it had decided to exit the heat pump water heater (HPWH) business and cease manufacturing its GeoSpring™ HPWH products at the end of 2016.

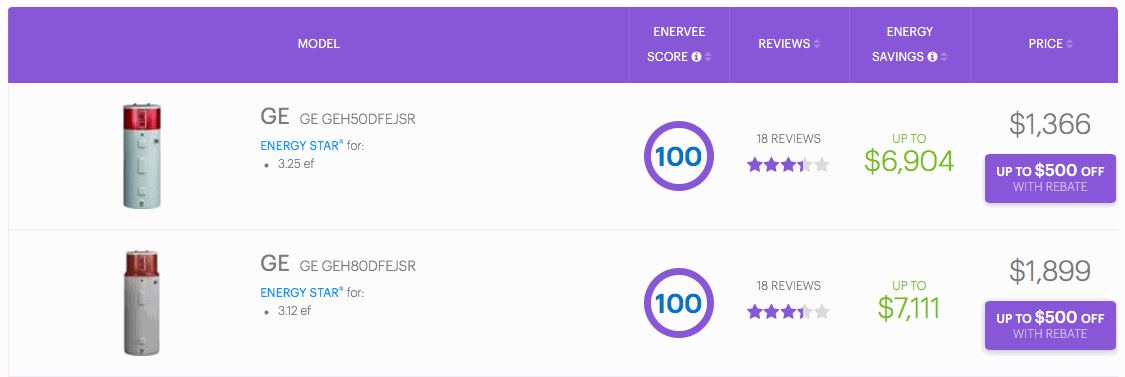

The two GeoSpring models are the most efficient models on the US market today, with top Enervee® Scores of 100.

So why would GE Appliances cease manufacturing them now, after investing $38 million in the new product line and upgraded manufacturing facility in Louisville as recently as 2012?

According to the press release:

Demand for HPWH products has failed to materialize at expected levels…the total HPWH segment is only expected to reach about 60K units in 2016 — less than 1.5% penetration of the available electric water heater category.

This is despite more ambitious federal energy efficiency standards that went into effect in April 2015, which should have stimulated sales of HPWH, particularly in the larger (> 55 gallon) size class. Instead, consumers have sent a signal that they are either not willing or unable to pay a higher upfront product acquisition price for the super-efficient heat pump water heaters — and have found alternatives, such as making due with smaller units or opting for grid-enabled electric-only water heaters of 75 gallons or more (which are subject to much less stringent efficiency requirements, because of their potential contribution to moderating peak electricity demand).

The fact that the significant energy cost savings over the life of the HPWH compared to a conventional electric water heater would more than pay for the product within a few years of purchase has not moved consumers.

Given continued weak consumer demand and GE Appliance’s failure to achieve the profitability needed to make the HPWH a viable product — despite the company’s best efforts to raise awareness and availability of utility incentives in the hundreds of dollars — the company’s decision to focus its resources on other products with greater consumer demand and growth potential is understandable. Will other manufacturers of HPWH follow suit?

We cannot afford to let this be the end of the story for heat pump water heater technology.

Water heating is on average the second largest household energy expense behind space heating, representing about 18% of total household energy consumption in the US — and heat pump water heaters are about 50% to 60% more efficient than electric-only models.

I’m banking on California. Without innovation to speed the efficiency improvement in energy-consuming products that people buy at retail, it will be virtually impossible to achieve the doubling of energy efficiency by 2030 mandated by SB 350, the State’s Clean Energy and Pollution Reduction Act. As the California Energy Commission considers statewide product efficiency strategy and updates the Existing Buildings Energy Efficiency Action Plan, the California Public Utilities Commission revamps utility regulation to encourage distributed clean energy resources and utilities develop business plans designed to transition to clean distributed energy resources, there is a unique opportunity to align efforts to drive innovation.

The water heaters are a good example. Water heaters offer a range of opportunities to reduce the societal cost of providing energy services, including fuel switching from gas to electric water heaters, advanced electric water heating load control and energy efficiency strategies. The challenge is to understand how the various technologies & strategies can be optimized – and then to engage with and empower customers to make beneficial choices.

This will not be easy. Customers will be looking for guidance to these complex choices, and will expect a user experience that offers comprehensive, personalized, 1-stop solutions that provide them with both simplicity and choice.

Enervee’s data-driven utility-branded Marketplaces position industry leaders to respond to these new customer expectations, while optimizing system benefits. Initially, customers are aided in making 1-time purchasing decisions and participating in various programs to promote distributed energy resources. Ultimately Marketplaces may well become a primary venue for end customers to actively participate in DER markets.

Meanwhile, it remains to be seen whether the market introduction of heat pump water heaters will be a success story, leading to rapid, widespread diffusion of a commercially available, cutting-edge product that will deliver energy savings and carbon reductions in the future. Governments, regulators and utilities all have a role to play — but, as we all know, consumers will ultimately call the shots. The better question, then, may be how can we provide the most efficient tools, the most compelling platforms, that engage and enable consumers to make the best choices?