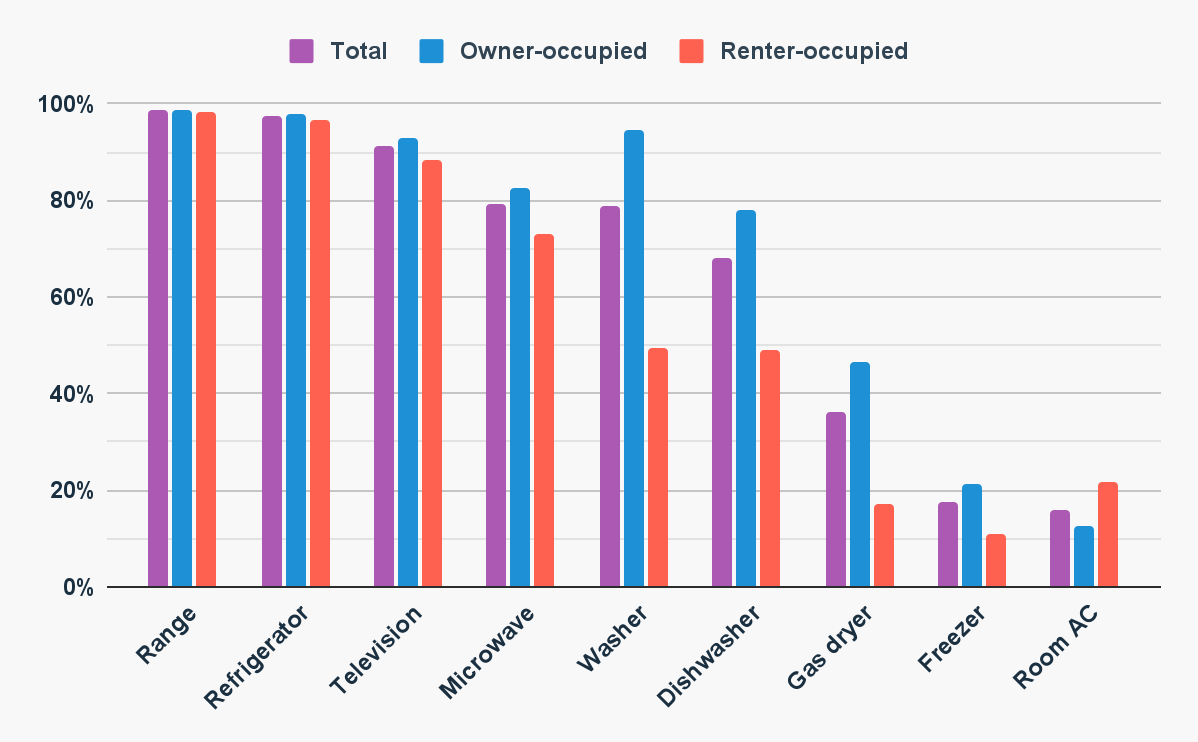

The share of U.S. households living in rental homes has grown in recent years—today, renters occupy roughly 36% of U.S. dwellings [1]. Rental homes are, on average, ~15% less energy-efficient than owner-occupied homes [2], yet the renter segment has been historically hard to reach with traditional utility energy efficiency programs.

This post looks at how Enervee’s Online Retail Eco Financing engages renters and what that tells us about scaling energy efficiency for renters—across both electric and gas appliance categories. For program delivery, pairing financing with a utility marketplace is key: eligibility, instant incentives (when available), transparent net pricing, and install are all handled in one flow.

Spoiler: Several widely held assumptions about renters deserve a fresh look.

Key takeaways

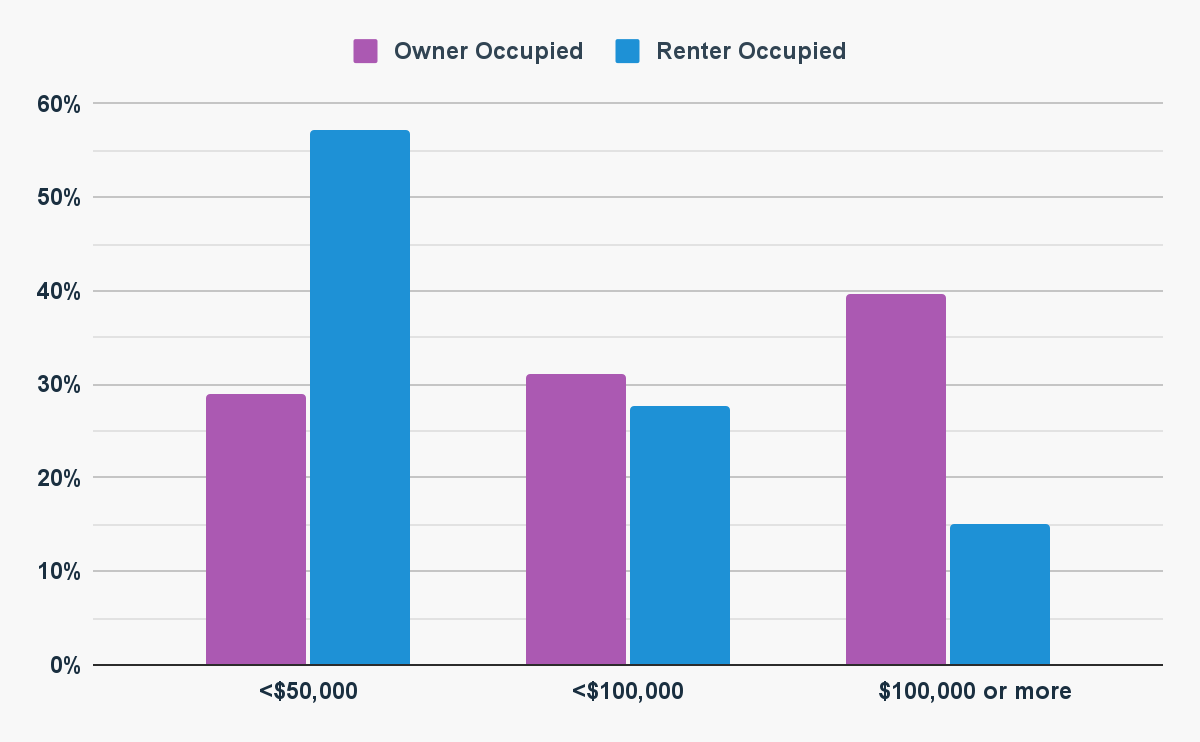

- Renters aren’t a monolith: many are long-tenured, and a meaningful share are higher-income and tech-forward [1][3].

- Eco Financing reaches renters at scale—without relying on product rebates—by converting big, one-time costs into affordable monthly payments.

- “Plug-in” appliances and devices are a high-leverage path for renter efficiency; they sidestep many landlord/authorization barriers.

Renters may not be who we think they are

Drawing on 2020 census estimates [1] and SECC’s 2021 renter insights [3]:

- Not all rentals are multi-family. 42% of renters live in single-family homes—and renters occupy 19% of all single-family homes.

- Renters ≠ low-income by default. While lower-income households are over-represented, nearly 20% of households with incomes above $100k rent. SECC notes more affluent, educated segments (e.g., Green Innovators, Tech-Savvy Protégés) increasingly choose to rent.

- Many renters are stable. ~42.7% have been in the same home 7+ years; only 9.2% moved within the last two years.

Evidence: renters can be reached—at checkout

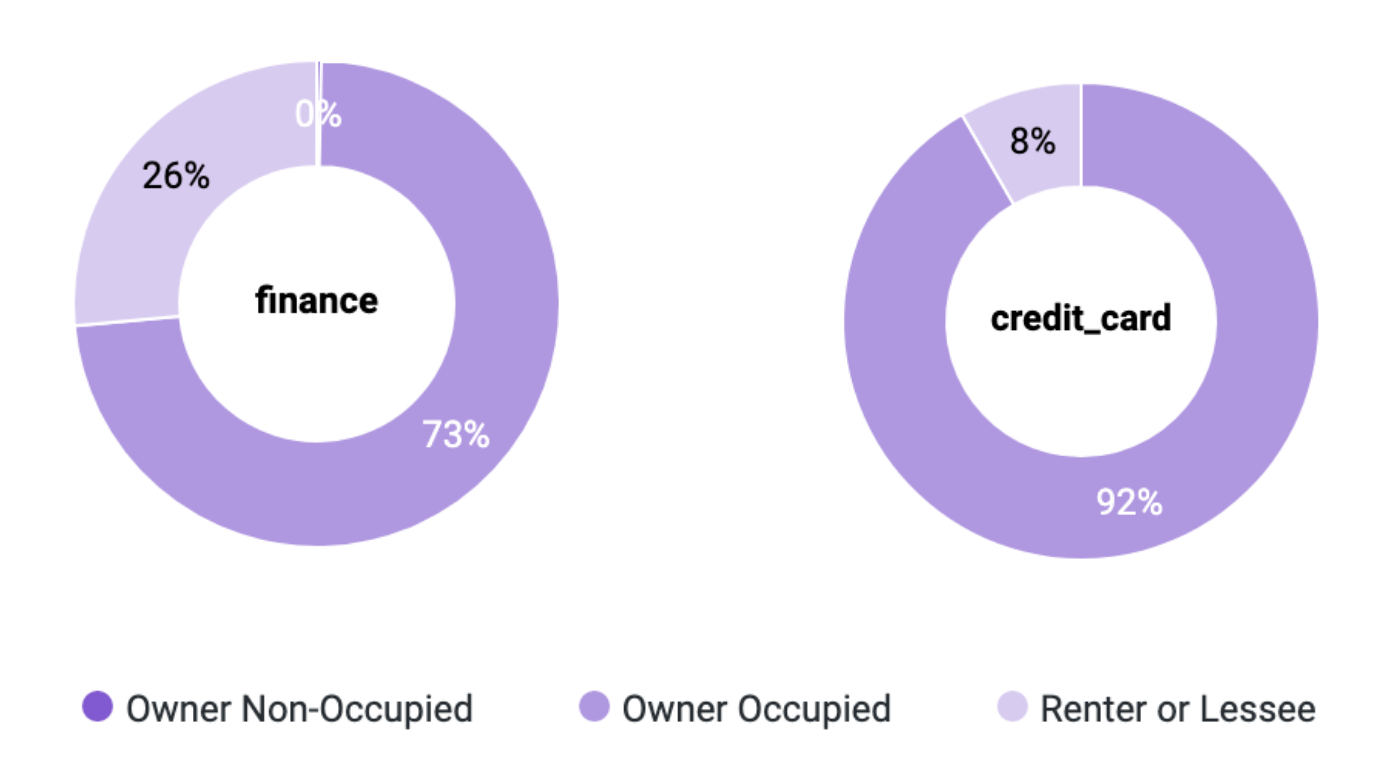

In a Southern California marketplace serving gas utility customers, shoppers can buy efficient appliances online and pay by credit card or an instant Eco Financing loan. For example, a $1,000 appliance can be purchased for under $25 per month (representative case).

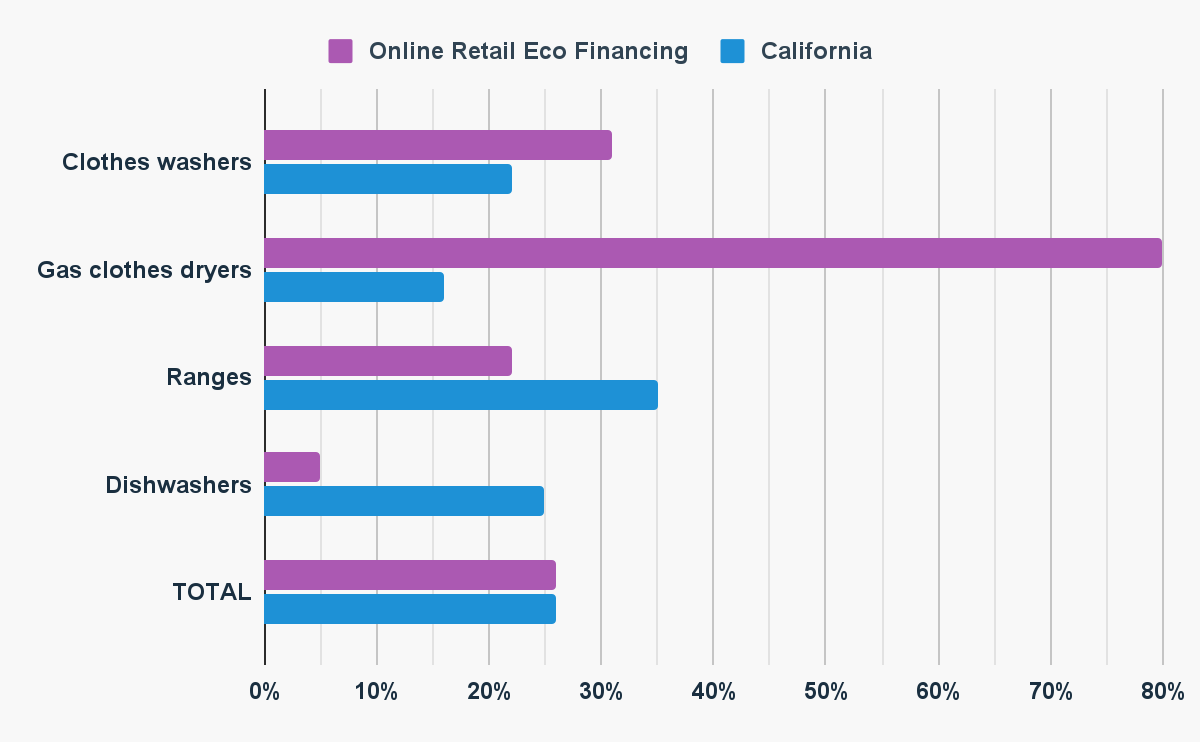

Financing is available on four major categories (ranges, clothes washers, gas clothes dryers, and dishwashers), with more being added.

Contrary to the belief that renters rarely purchase large appliances, ~26% of Eco Financing loans go to renters—mirroring the share of these four appliances present in California rentals overall [5].

Eco Financing is over-indexed for renters purchasing gas dryers and clothes washers. Even though only 17% of California rentals have gas dryers (47% for owners), over 80% of financed gas dryers in this program go to renters. (Note: statewide data for “ranges” includes cooktops/stovetops; the financing data is ranges only.)

Bottom line: A utility marketplace with instant, inclusive monthly payments can reach renters at scale—even without product rebates—by meeting them at the moment of need.

Three renter myths to revisit

Myth 1: “Renters have no incentive to invest in efficient appliances.”

Program data show the opposite. Renters are financing major appliance purchases (average cart ~$1,400). SECC reports that, in many markets, affluent tenants actively improve in-unit efficiency. And among financed purchases, ~70% are LMI borrowers—suggesting access to monthly payments, not rebates, is the unlock.

Myth 2: “Renters move too often to justify upgrades.”

Not necessarily. SECC found that 55% of renters have lived at the same address for 4+ years; 20% for 11+ years. Census data indicate 42.7% have stayed 7+ years. Many “plug-in” appliances can also move with the tenant.

Myth 3: “Renters can’t authorize purchases.”

Barriers exist for structural upgrades, but most savings opportunity is with plug-in appliances/devices. In Marin Clean Energy research, 72% of single-family renters reported they can authorize appliance purchases; 26% of multi-family renters can, too [6]. Marketplace fulfillment also reduces “unknown program” trust barriers—customers buy from retailers they already use.

What about multi-family property owners?

Per Harvard JCHS, individuals own the vast majority of single-family rentals (76%) and 2–4 unit buildings (77%); institutional owners dominate only the largest multi-family [4]. Since ~60% of renters live in individually owned properties, influencing individual purchase decisions (owners and property managers) is critical. Financing helps overcome cash-flow constraints noted by smaller, for-profit managers [6].

The bottom line: empower renters to buy efficient

- Focus on plug-ins. Plug loads drive a majority of residential electricity use; renters can choose and install most of these products themselves.

- Serve small multi-family owners. Individuals and their managers influence purchases for 60% of renters; design programs that meet their buying reality.

- Remove friction at checkout. Instant eligibility + net price + Eco Financing convert intent into action—even without rebates.

Renters are diverse. Eco Financing isn’t right for everyone, but it’s already proven effective at driving renter purchases of energy-efficient appliances—including among LMI customers—by removing the up-front cost barrier.

References

- Census 2020 ACS 5-Year Estimates.

- ACEEE, Energy Equity for Renters.

- SECC, Understanding the Needs and Wants of Renters (2021).

- Harvard Joint Center for Housing Studies, America’s Rental Housing 2020.

- California Energy Commission, 2019 Residential Appliance Saturation Study.

- Apex Analytics, MCE Residential Market Assessment: Final Report.